50 Questions on

Accounting Journal Entries

App Description:

This app provides an easy-to-access summary of essential knowledge on how to prepare accounting journal entries.

Basic concepts are structured in a question-and-answer format for instant application to real-world transactions.

Read questions and answers in "Review Mode" first and then test your understanding by using the "Quiz Mode" feature. You can switch between review and quiz modes at any time.

This app was designed to help:

(1) Students who are currently taking an introductory financial accounting course;

(2) Students who wish to refresh their understanding of accounting journal entries; and

(3) Business professionals who would like an overview of the double-entry recording system, including the concepts of debits and credits.

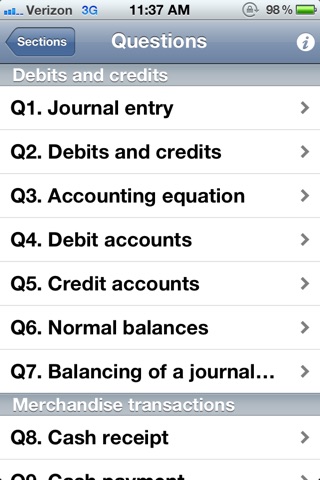

The app includes 50 questions organized into 8 sections:

Q. 1-7: Debits and credits

Q1. Journal entry

Q2. Debits and credits

Q3. Accounting equation

Q4. Debit accounts

Q5. Credit accounts

Q6. Normal balances

Q7. Balancing of a journal entry

Q. 8-13: Merchandise transactions

Q8. Cash receipt

Q9. Cash payment

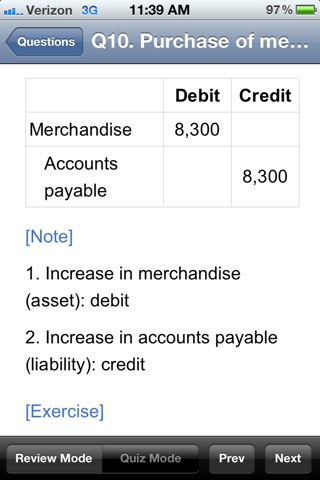

Q10. Purchase of merchandise

Q11. Sale of merchandise

Q12. Cost of goods sold

Q13. Gross profit

Q. 14-17: Accrual basis accounting

Q14. Prepaid expenses

Q15. Accrued expenses

Q16. Unearned revenue

Q17. Accrued revenue

Q. 18-24: Assets

Q18. Accounts receivable

Q19. Notes receivable

Q20. Allowance for doubtful accounts

Q21. Purchase of equipment

Q22. Depreciation

Q23. Sale of equipment

Q24. Goodwill

Q. 25-30: Liabilities

Q25. Accounts payable

Q26. Notes payable

Q27. Salaries payable

Q28. Income taxes payable

Q29. Issuance of bonds payable

Q30. Repayment of bonds payable

Q. 31-34: Equity

Q31. Issuance of common stock

Q32. Cash dividend

Q33. Stock dividend

Q. 35-45: Summary

Q35. Debits and credits

Q36. Merchandise transactions

Q37. Accounts receivable

Q38. Prepaid expenses

Q39. Unearned revenue

Q40. Purchase of noncurrent assets

Q41. Depreciation

Q42. Sale of noncurrent assets

Q43. Borrowings

Q44. Common stock

Q45. Cash dividend

Q. 46-50: Review

Q46. Review questions 1

Q47. Review questions 2

Q48. Review questions 3

Q49. Review questions 4

Q50. Review questions 5